The agenda includes participation in the China International Cotton Conference and the “Cotton Brazil Outlook” seminar in Seoul.

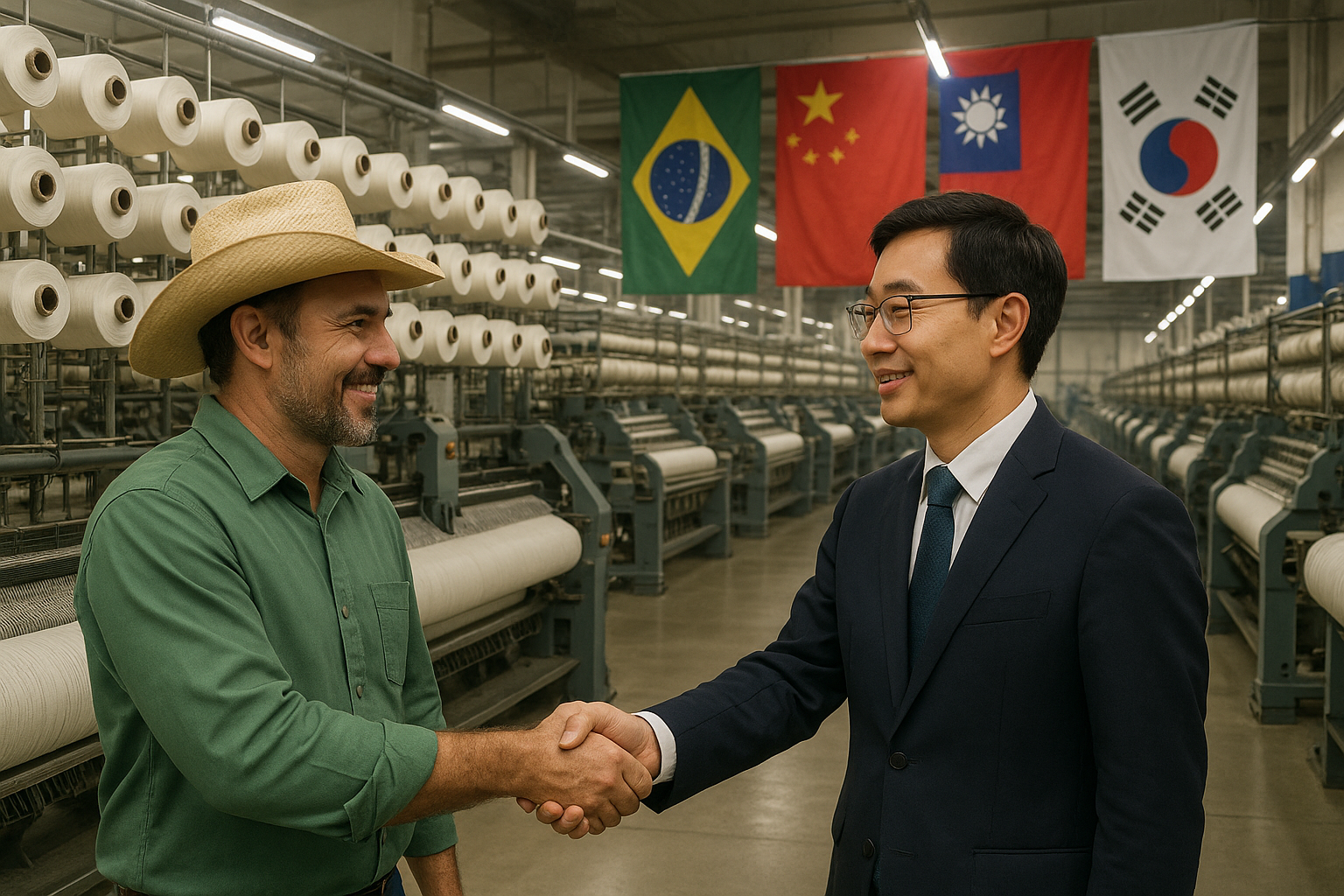

From June 10th to 17th, the Brazilian Cotton Growers Association (Abrapa), through the Cotton Brazil initiative which promotes Brazilian cotton on a global scale, will be departing on a mission to China, Taiwan and South Korea with the aim of deepening trade relations between Brazilian cotton growers and Asian importers. The delegation, consisting of six representatives from Abrapa, Ampa (the Mato Grosso Cotton Growers Association), Abapa (the Bahia Cotton Growers Association), and Anea (the National Cotton Shippers Association), will participate in meetings and events to strengthen trade ties with business owners and strategic stakeholders for the cotton sector in Brazil.

The mission will begin in the Chinese city of Guangzhou with a business dinner for the main stakeholders of Brazilian cotton in China. On June 11th and 12th, the group will participate in the China International Cotton Conference (CICC 2025), one of the largest events in the Chinese textile industry. The conference, which is held every two years, will this year have the theme of Advancing Sustainable Cotton Development, Jointly Shaping the New Era of Consumption. Marcelo Duarte, director of International Relations at Abrapa, will be the official speaker at the event – as was the case in 2021 and 2023. In his presentation, Mr. Duarte will talk about the status of the Brazilian crop in the 2025/26 cycle as well as export prospects.

This is Abrapa’s second visit to China this year with the aim of strengthening trade ties with the country’s textile sector. In April, Cotton Brazil accompanied the Brazilian Government’s official mission to China. In addition to being the main destination for Brazilian cotton for some time, China has great potential for future trade partnerships with Brazil, explains Abrapa president Gustavo Piccoli.

“Even with the reduction in Chinese imports in this cycle, due to the good domestic crop and the instability of world trade with the tariff war, we continue to be a preferred supplier of cotton to China. And we can expand our collaboration even further,” Piccoli pointed out.

Product diversification

The use of cotton as an input for the Chinese animal feed industry is also on the agenda of Abrapa’s mission. There will be a technical/commercial visit to the Haid Group, a business conglomerate specialized in livestock, located in the Chinese province of Guangdong. With more than 600 branches around the world, the group has already expressed interest in investing in Brazil to process cottonseed.

On June 13th, the delegation will head to Taipei for a meeting with leading industrialists, traders and local business leaders.

Business Strategy in South Korea

The mission’s schedule will conclude in Seoul, the capital of South Korea, which will host an edition of the “Cotton Brazil Outlook” seminar on the 16th. The event will be held in partnership with the Spinners & Weavers Association of Korea (SWAK), the main representative body of the South Korean textile industry. SWAK represents companies that account for around 84% of total cotton consumption in the country and 95% of the cotton imported by this Asian partner.

South Korea’s textile sector has seen significant growth in recent years, being one of the main drivers of the country’s industrialization. According to Mr. Duarte, South Korea is a strategic partner for Brazilian exports as it is a country with a highly developed industry in relation to the textile and design market. “In the last market year, Korea ranked 8th among the countries that bought the most cotton from Brazil. Currently, 48% of all cotton imported by Korea is Brazilian and we believe that closer economic ties, with regard to the cotton sector, could further increase the presence of our cotton in the South Korean industry.”

Exports in numbers

Both China and South Korea are consolidated partners of Brazilian cotton. In the 2023/24 market year, Brazilian cotton represented 40% of Chinese imports and 48% of South Korean acquisitions.

From August 2024 to April 2025, Brazil exported 440.8 thousand tonnes of cotton to China (equivalent to 18% of the total exported). South Korea imported 31.5 thousand tonnes in the same period.