Brazil assures China of regular supply of cotton

Calendar and Events |

Faced with a challenging trade and geopolitical scenario, this year China found in Brazil a trusted partner and cotton supplier. Between January and April 2024, the South American country accounted for almost 48% of China’s cotton imports. Six years ago, Brazil’s share was 6%.

From August 2023 to April 2024, China purchased 1.2 million tonnes of Brazilian cotton – more than the total amount traded in the whole 2022/23 season. “If this trend continues, we can double the historical record of 2020/21, which was 720,500 tonnes,” said Alexandre Schenkel, president of the Brazilian Cotton Growers Association (Abrapa).

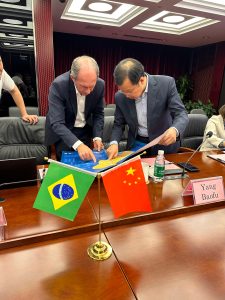

To enhance relations between the two countries in the cotton market, Abrapa has undertaken a ten-day trade mission to China. Since May 28th, a Brazilian delegation with nine members of Abrapa and the National Cotton Shippers Association (Anea) has been in China making technical visits, attending events and holding meetings.

This mission is part of Cotton Brazil’s calendar. Cotton Brazil is an Abrapa program that represents the Brazilian cotton production chain on a global scale.

In charge of the Cotton Brazil program is Abrapa’s Director of International Relations, Marcelo Duarte, who laid out two reasons for China’s closeness to Brazil. “With the ongoing trade and geopolitical conflicts with the United States and Australia, Brazil is working to enhance its leadership in the global market,” explained Mr. Duarte.

Numbers are impressive

Brazil is expected to export a final total of 2.5 million tonnes in the 2023/24 trade cycle. “It’s an actual revolution. In the 1990s, we were the second largest importer of cotton, but now, 30 years later, we have become the second largest exporter, while still meeting the demands of our domestic market,” added Marcelo Duarte.

Another positive aspect is the fact that Brazil has combined production efficiency with sustainable practices. “Since 1990, we have reduced cotton acreage by more than 50%. Currently, we use only 0.2% of Brazilian territory to produce 3.5 million tonnes – 400% more than in the 1990s,” said Abrapa’s director. Official Brazilian government data shows that 66% of the Brazil’s area consists of native vegetation which is maintained and preserved in protected areas.

The sustainable evolution of Brazilian cotton farming was the central theme of Marcelo Duarte’s presentation during the global trend panel of the “2024 China Cotton Industry Development Summit”, an annual event held by the China National Cotton Exchange (CNCE) in Xi’an, China. For the third consecutive year, Marcelo represented Brazil alongside speakers from the United States and Australia.

The event brought together around 800 attendees from around the world and presented an overview of how the cotton and textile sectors will likely behave next year. Among the highlights were the lowest US cotton harvest in the last 37 years, as recorded for the 2023/24 season, and the increase China’s imports, reaching the highest level in ten years

Medium-term projections, however, raise some uncertainties. Adverse weather events in producing countries make it difficult to predict cotton supplies. At the same time, the emergence of new legislation and the advancement of synthetic fabric production further complicate estimates for cotton demand.

The overall balance of Brazil’s presence at the event was positive. “We leave the CNCE conference confident that Brazil is on track to maintain and strengthen its market position. It is a journey of continuous improvement and our focus is to continue working to provide the world with this important sustainable and renewable fibre,” Abrapa’s director concluded.

Cotton Brazil’s mission included visits to Xi’an, Shanghai, Ningbo and Beijing for working meetings and technical visits to government agencies, as well as spinning and textile mills.

About Cotton Brazil

The Cotton Brazil program began in 2020 and is run by Abrapa in partnership with the Brazilian Trade and Investment Promotion Agency (Apex Brasil). The program has an Asian office based in Singapore.